Written by: Jonathan Lewis and Anna Menke

View the original article here

Low-emissions hydrogen is a critical component of the climate change solution set, and it is likely to play a significant role in affordably achieving full, economy-wide decarbonization by midcentury. Electrification will achieve much of the decarbonization needed, but more than 80% of final energy use in the U.S. comes from fuels. Many existing fuel uses can be electrified, but electrifying some hard-to-abate sectors of the economy (such as long-haul heavy-duty trucking, marine shipping, and ironmaking) may be either commercially impossible or prohibitively expensive. For these sectors, we will need zero-carbon fuels, namely hydrogen and ammonia, to reach full decarbonization. Accordingly, the International Energy Agency (IEA) projects that the world’s demand for hydrogen could increase by almost 500% between 2020 and 2050.

To catapult the United States on a path towards commercial scale clean hydrogen production, the 2021 Infrastructure Investment and Jobs Act (IIJA) allocated $8 billion for the Department of Energy (DOE) to fund at least four Regional Clean Hydrogen Hubs — or H2 Hubs — across the country. The program is designed to demonstrate viability of new production and end-use technologies for clean hydrogen, and to drastically bring the cost of production down.

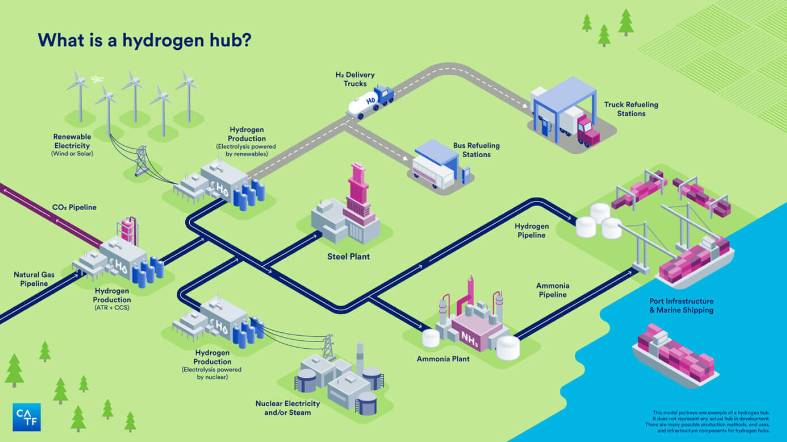

A clean hydrogen hub is a co-located network of infrastructure needed to produce, transport, store, and use clean hydrogen in a functional regional market. The program intends to demonstrate localized production and end use of hydrogen and to create a connected synergistic hydrogen economy across the United States.

In parallel to DOE’s H2 Hubs program, DOE and the Department of Transportation (DOT) are pursuing several additional measures to promote the deployment of hydrogen-fueled trucks and ammonia-powered marine vessels, including the IIJA’s National Alternative Fuel Corridors Program — a piece of the $2.5 billion Charging and Fueling Infrastructure competitive grant program that is designed to support the build-out of clean charging and fueling infrastructure projects along designated alternative fuel corridors of the National Highway System.

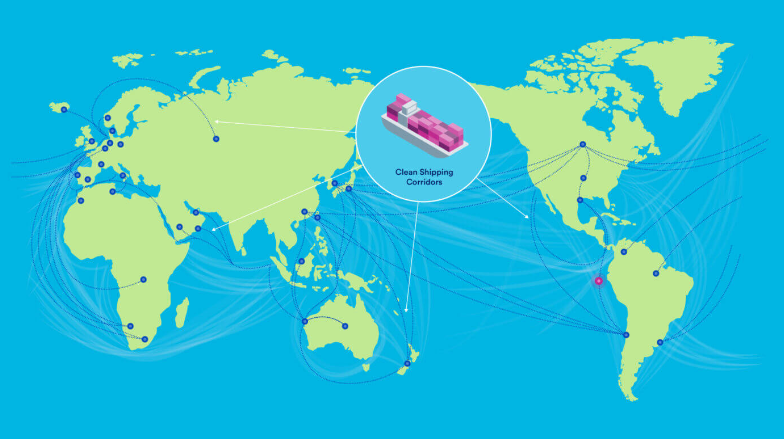

Clean transportation corridors include routes for heavy-duty trucks that run on hydrogen to transport their freight across multiple states, provinces, or even countries, as well as transoceanic shipping routes for vessels that run on ammonia. In the future, clean corridors will also include airline routes serviced by aircraft that are powered by hydrogen or other zero-carbon fuels. Clean transportation corridors will be necessary to turn H2 Hubs from islands into a network, allowing hydrogen and other resources to move between hubs and simultaneously creating a steady demand base for hydrogen to fuel the transportation corridors themselves.

Moving from competition to connection between H2 Hubs

CATF has previously written about the elements that individual hubs should prioritize as they develop their proposals to DOE, including low-carbon production pathways, hard-to-decarbonize end uses, the creation of community and local environmental benefits, and long-term economic viability.

On April 7, 2023, final applications were submitted from hub developers across the country hopeful to receive funding from the Department of Energy. The application process for the DOE Regional Clean Hydrogen Hubs program is long and applicants have recently entered a new phase – the waiting period between application submission and award negotiations and selections. Until this point in the process, the focus and feel between hub hopefuls has been competitive with more than 20 known hub efforts competing for $8B in funding to be spread amongst the 4 to 10 hubs that will be selected by DOE. As award selections and negotiations evolve over the spring, summer, and into the fall, we expect to see more tangible production proposals, off-taker agreements, robust community engagement efforts, and greater collaboration and coordination between the various hub efforts.

In addition to getting specific within each hub proposal, this phase of the program creates an opportunity for hub developers and the Department of Energy to start thinking collaboratively. Proactive planning to connect hubs can strengthen individual proposals and improve the likelihood of long-term success for the collective H2 Hubs program. As the Department of Energy’s Clean Hydrogen Liftoff report points out, the development of ‘midstream infrastructure’ will be crucial to getting hydrogen to commercial scale. For the H2 Hubs program, this midstream infrastructure will include hydrogen storage, carbon storage, and transportation infrastructure. The ability to move hydrogen efficiently and safely between hubs — while minimizing hydrogen leaks throughout the process — will be an essential part of the H2 Hubs program. There is the potential to create a national network that simultaneously allows for distribution and hydrogen refueling across the country while bolstering demand for hydrogen and creating benefits for communities.

The importance of linking clean transportation corridors and H2 Hubs

Clean transportation corridors have the potential to bolster the economic viability of H2 Hubs and create benefits to communities. To date, Congress and the U.S. DOE have focused primarily on supply-side policies for hydrogen; including the Regional Clean Hydrogen Hubs Program and the Hydrogen Production Tax credit (45V). Recently, focus has begun to shift to demand-side measures that could help give certainty to hub developers that off takers will be there for the hydrogen they produce. DOE and DOT’s investments in and development of clean, hydrogen-fueled transportation corridors will aid in demand-side certainty for H2 Hubs in two ways:

- Clean transportation corridors that support trucks and marine vessels that run on hydrogen or hydrogen-based fuels will broaden the market for low-carbon hydrogen by increasing demand beyond the industrial off takers that are typically located next door to hydrogen production sites.

- The corridors will also expand the geographic reach of H2 Hubs by extending demand for decarbonized hydrogen along spokes — i.e., highways and/or marine shipping routes — that connect each hub region to other cities and ports.

Additionally, clean transportation corridors have an important role not only in curbing harmful CO2 emissions but also in curbing conventional air pollutants from diesel powered trucking which disproportionately affect environmental justice communities across the country. As H2 Hubs evaluate the benefits they may be able to create for communities near and far, they should consider the transportation routes stemming from their hubs that could transition to be hydrogen-fueled clean transportation corridors and should begin benchmarking the public health benefits that may accrue to communities as a result.

The first awardees of the DOE and DOT clean transportation corridors grant program were announced in February and include several awardees focused on developing hydrogen-fueled clean transportation corridors:

- CALSTART: East Coast Commercial ZEV Corridor along the I-95 freight corridor from Georgia to New Jersey.

- Cummins Inc.: MD-HD ZEV Infrastructure Planning with Focus on I-80 Midwest Corridor serving Indiana, Illinois, and Ohio.

- GTI Energy: Houston to Los Angeles (H2LA)–I-10 Hydrogen Corridor Project.

- Utah State University: Wasatch Front Multi-Modal Corridor Electrification Plan for the Greater Salt Lake City Region.

CATF sees a key opportunity for H2 Hubs and clean corridors grant recipients to coordinate to develop an interconnected hydrogen network across the United States.

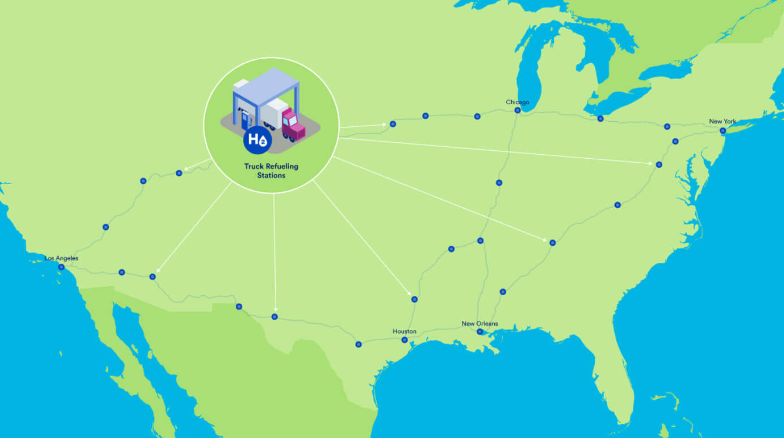

Imagining hubs connected via clean transportation corridors

Given that around half of the hydrogen production in the United States currently takes place in the Gulf Coast, let’s assume the example of a hydrogen hub depicted in the graphic above is in the Houston region. If a Houston-based hub were to be selected, there would be at least three and at most nine other hydrogen hubs under development in the United States per the requirements of IIJA’s Regional Clean Hydrogen Hub provision. Meaning, the hypothetical hub in Houston isn’t the only one of its kind, and a hydrogen-powered truck that fuels up in Houston isn’t limited to conducting only local deliveries. There are other places it could carry its freight to, if those places — and the routes along the way — also have hydrogen fueling capacity.

If a hub in Chicago and the Upper Midwest/Great Lakes region was also selected, the ability to move goods between Houston and Chicago and points in between would improve the use-case for hydrogen trucks purchased in those regions — which in turn would benefit hydrogen truck manufacturers, producers of low-carbon hydrogen, and, most pertinently, air quality and the climate.

The success of this Houston-Chicago clean hydrogen corridor could be replicated with corridors that connect those regions to other potential hosts of federally backed regional clean hydrogen hubs. Once there are hydrogen production facilities in places like Los Angeles, New Orleans, and New York, along with hydrogen fueling stations along the interstate highways that connect them, the viability of hydrogen-fueled trucks would improve dramatically, the market for low-emissions hydrogen would increase, and both sectors would benefit from growing economies of scale.

The success of this Houston-Chicago clean hydrogen corridor could be replicated with corridors that connect those regions to other potential hosts of federally backed regional clean hydrogen hubs. Once there are hydrogen production facilities in places like Los Angeles, New Orleans, and New York, along with hydrogen fueling stations along the interstate highways that connect them, the viability of hydrogen-fueled trucks would improve dramatically, the market for low-emissions hydrogen would increase, and both sectors would benefit from growing economies of scale.

Concluding: How DOE and hub developers can support the development of clean transportation corridors

Building synergistic linkages between H2 Hubs and clean trucking and shipping corridors requires multi-market investments by fuel providers, fleet owners, and other market participants; support and coordination from federal and state agencies; and constructive input and oversight from communities, NGOs, and universities.

As discussed above, DOE, DOT, and other U.S. government agencies are working on multiple fronts to implement key provisions in the IIJA and the Inflation Reduction Act that will support the deployment of clean energy production and utilization technologies including hydrogen and zero emissions vehicles. More can be done, however, to ensure that the H2 Hubs and clean corridors programs are well coordinated. The seven grant recipients of DOE and DOT’s program “to accelerate the creation zero-emission vehicle corridors” cover highway systems across the country and meanwhile, nearly every state in the U.S. is represented in the hub projects proposed to DOE’s H2 Hubs program. The extent to which the seven funded corridor efforts match up geographically with regional hydrogen hub efforts is not yet known, because the Regional Clean Hydrogen Hubs program funding recipients will not be announced until later this year.

may proceed irrespective of DOE funding decisions. Accordingly, CATF is connecting with DOE, hydrogen hub developers, trucking companies, and others to spotlight the opportunities for constructively linking clean corridor development and H2 Hub development. We’re encouraging H2 Hub project developers to look for ways to integrate clean corridor plans into their strategy, in part by involving entities like Cummins, GTI Energy, CALSTART, and Utah State University that received initial clean corridor grants from DOE and plan to support hydrogen refueling infrastructure as part of their projects.

Given the likely importance of hydrogen to the decarbonization of long-haul heavy-duty trucks, DOE and DOT should account for H2 Hub development when determining when and how to expand the clean corridors program, and the agencies should prioritize the development of hydrogen fueling infrastructure along routes that span between H2 Hub regions. Additionally, H2 Hub applicants and DOE should consider how clean corridors can be leveraged to improve demand-side certainty and to create meaningful benefits for communities. As selections are announced later this fall, CATF looks forward to collaborating with clean corridor grant recipients, H2 Hub awardees, and other stakeholders to support the development of a connected clean hydrogen ecosystem across the United States.