By The Enel X Energy Intelligence Team, Strategy

View the original article here.

As America enters its second month of widespread lockdowns, the effects of these measures are becoming clearer, especially in electricity demand. Data from the largest United States regional transmission operators (RTOs) show grid-wide declines in electricity usage.

However, because this data includes commercial, industrial and residential end users, the true impacts to specific sectors of the economy are largely hidden—increases in residential energy demand partially or entirely offset significant declines seen in commercial demand. Below, Enel X provides an inside look at our internal data to show how the effects of coronavirus are being felt across individual sectors.

The Broader Picture: Energy Demand Is Down

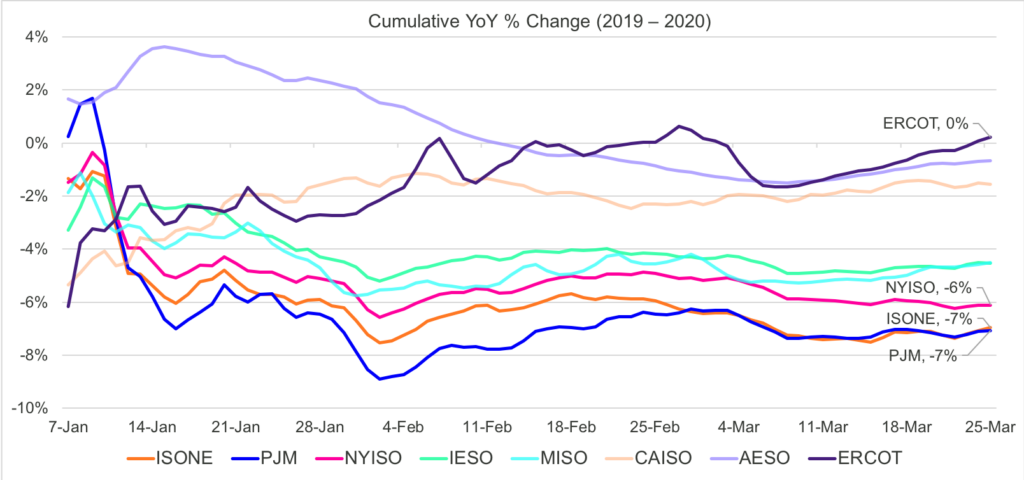

Grid-wide RTO data shows that energy demand is broadly down for the entirety of 2020. In the first two months of 2020, a mild winter led to lower-than-average consumption due to a decline in heating demand. Then, in mid-March, coronavirus shutdowns led to further drops in demand.

Every year will include variations due to temperature fluctuations, but this sustained and ongoing drop has some analysts worried about long-term effects on consumers. A decline of this magnitude, as James Newcomb of the Rocky Mountain Institute told Utility Dive, could severely affect revenue for utilities. To recoup their losses, utilities may have to increase customer rates.

The drop since mid-March is even more noteworthy when controlling for factors like temperature—The New York Times highlighted work by Steve Cicala, an economics professor at the University of Chicago, who has demonstrated that changes in electricity demand closely tracked changes in GDP during the 2008 financial crisis. Currently, Cicala’s adjusted numbers find electricity demand down about 8% from expectations as of April 6th.

Enel X Internal Data: A Drop in Demand Across Sectors, With Notable Exceptions

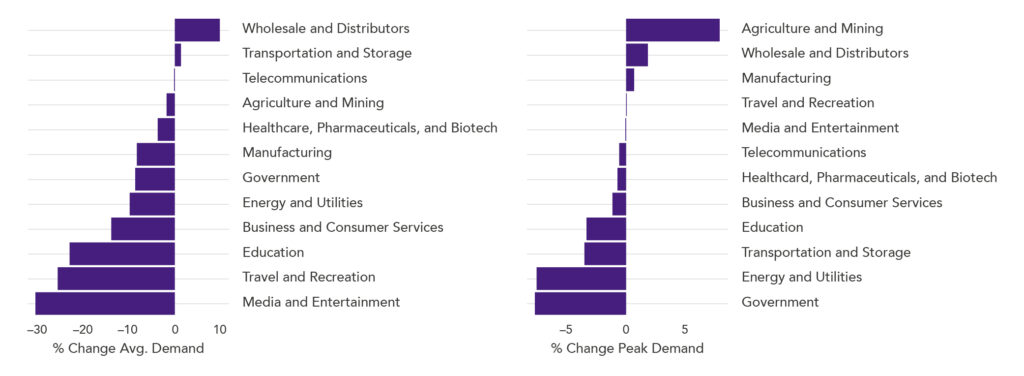

Grid-wide data does not tell the story of specific industries, though, and the aggregate numbers include residential data. Internal data from our commercial and industrial customers – who represent approximately 2% of demand across USA and Canada—tells a more detailed story. Most commercial and industrial sectors have seen far more significant declines in consumption than the grid-wide data suggests.

The industries at the bottom of the chart are those with the most drastic reductions, and they are largely unsurprising—media and entertainment is considered inessential, flights are restricted, and schools are closed.

Increases show that some businesses – or even entire industries – are now ramping up their efforts and being called upon to work harder than ever. Manufacturing has seen a moderate decline in average demand, but our numbers show the sector has seen an uptick in peak demand.

In part, this may be because many individual manufacturers are operating at a higher level than ever before. One customer we spoke to – a manufacturer of household foods – explained just how much has changed this past month. As a result of quarantine orders and increases in grocery demand, they said, their products have been flying off of shelves. Their order volume has gone up significantly as a result, and that’s led to much higher production levels—what is normally a 24/5 plant has become 24/7, and the plant itself is expanding.

“Even as demand returns to normal,” the customer told us, “our plant will have to work at higher than normal production levels likely until at least the end of the year.”

What Lies Ahead

Professor Cicala notes that the United States’ electricity trend has tracked Europe with a lag, indicating a further drop may be coming. The grid-wide data shows there is room to fall—ERCOT (Texas), for instance, only implemented state-wide lockdowns on April 2.

If widespread shutdowns and work-from-home measures remain in place when warm summer months arrive, consumption could vary greatly from normal patterns. Commercial buildings often have more efficient cooling systems than personal homes, and offices generally have fewer cubic feet per person than a home does.

While it’s too soon to tell what long-term implications the virus will have on the energy sector, the impact has already been felt in the way homes and businesses are using electricity.