By: Shira Rubin

View the original article here

A cadre of start-ups are building batteries that can store renewable energy in natural materials such as sand, salt and rock.

TAMPERE, Finland — When Russia halted gas and oil exports to Europe following its invasion of Ukraine, hundreds of millions of citizens agonized over the prospect of a winter without enough heating and a summer without enough air conditioning.

But the Kremlin’s wartime strategy to shut the taps on its fossil fuels has coincided with, and also catalyzed, a critical sector for the clean energy transition — batteries made from inexpensive and abundant natural materials that store heat.

The use of sand, salt, heat, air and other elements as energy banks dates back centuries. The walls of ancient Egyptian homes captured solar heat during the day and released it during cool desert nights. Indigenous peoples across the Americas valued adobe — a composite of earth, water, and other organic materials like straw or dung — as a preferred construction material for its ability to do the same.

For modern civilizations whose industrial development has been powered by the combustion of fossil fuels, these materials offer a revolutionary premise: “Nothing is burned,” said Tommi Eronen, chief executive of Polar Night Energy, a Finnish start-up running the world’s first commercial-scale sand battery.

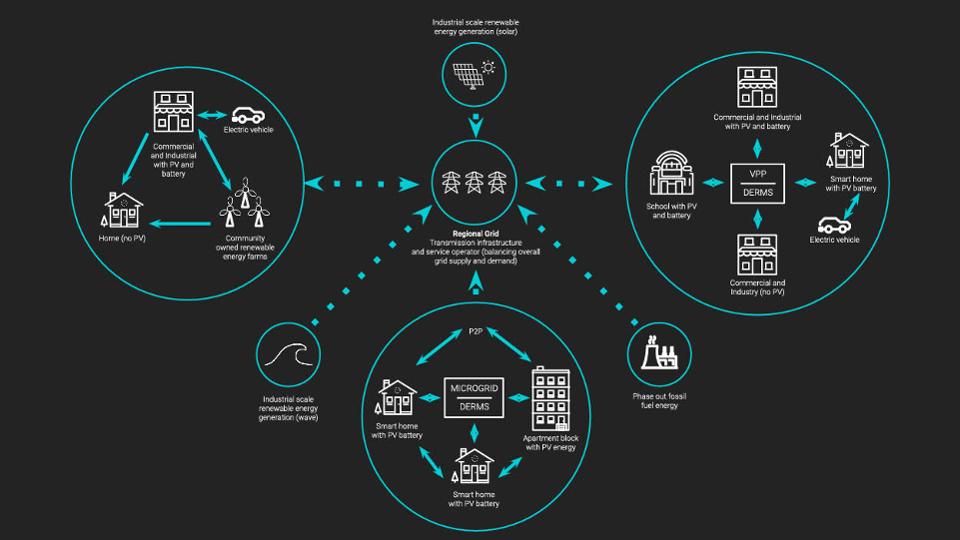

Natural batteries are meant to enable countries to take advantage of prodigious supplies coming from wind turbines and solar panels, when the sun isn’t shining and the wind isn’t blowing. The price of renewables remains below the cost for fossil fuels —especially after a Russian fuel pullback drove prices across Europe to record highs — but the green energy revolution still faces a hugeobstacle: a lack of long-term, cost-efficient renewable storage.

At Polar Night Energy’s facilities in the city of Tampere and the nearby town of Kankaanpää, hulking steel vats hold heaps of sand, heated to around 1,000 degrees Fahrenheit. That stored energyhelps to smooth out power grid spikes and back up district heating networks, keeping homes, offices, saunas and swimming pools warm. The heat keeps flowing, even in remote areas, even as Russian fossil fuel supplies dwindle.

“Sand has almost no limits,” said Ville Kivioja, Polar Night Energy’s lead scientist, speaking over the whirring sound of the substance circulating. “And it’s everywhere.”

How natural batteries work

The sensors and valves that monitor the sand battery’s performance are relatively high-tech, said Kivioja, but, by design, the battery itself is simple.

The sand is trucked in from anywhere nearby — a demolished building site or sand dunes, for example — and costs less than a euro per ton. It is dumped into a giant vat, or “battery,” which is consistently kept hot, or “charged.”

The renewable energy from solar panels and wind turbines is converted into heat by a resistance heater, which also heats the air that swirls through the sand. A fan circulates the flow of heat continuously, until it’s ready to use. Like a boulder in the sun, the sand remains hot even after sundown — except unlike the boulder, the sand never gets cold because it’s insulated by the enormous vat. Even when the battery level is low, the temperature remains above 200 degrees Fahrenheit; when it is full, it can surpass 1,000 degrees.

The sand can hold onto the power for weeks or months at a time — a clear advantage over the lithium ion battery, the giant of today’s battery market, which usually can hold energy for only a number of hours.

Polar Night Energy prefers to use sand or sand-like materials that are not suitable for construction industry. This enables the usage of materials that are locally and commonly available or even considered as waste. (Polar Night Energy)

A natural battery rush

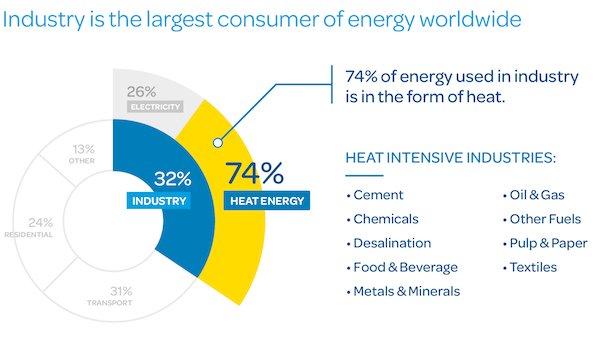

Unlike fossil fuels, which can be easily transported and stored, solar and wind supplies fluctuate. Most of the renewable power that isn’t used immediately is lost.

The solution is storage innovation, many industry experts agree. In addition to their limited capacity, lithium ionbatteries, which are used to power everything from mobile phones to laptops to electric vehicles, tend to fade with every recharge and are highly flammable, resulting in a growing number of deadly fires across the world.

The extraction of cobalt, the lucrative raw material used in lithium ion batteries, also relies on child labor. U.N. agencies have estimated that 40,000 boys and girls work in the industry, with few safety measures and paltry compensation.

These serious environmental and human rights challenges pose a problem for the electric vehicle industry, which requires a huge supply of critical minerals.

So investors are now pouring money into even bigger battery ventures. More than $900 million has been invested in clean storage technologies since 2021, up from $360 million the year before, according to the Long Duration Energy Storage Council, an organization launched after that year’s U.N. climate conference to oversee the world’s decarbonization. The group predicts that by 2040, large-scale,renewable energy storage investments could reach $3 trillion.

That includes efforts to turn natural materials into batteries.Once-obscure start-ups, experimenting with once-humble commodities, are suddenly receiving millions in government and private funding. There’s the multi-megawatt CO2 battery in Sardinia, a rock-based storage system in Tuscany, and a Swiss company that’s moving massive bricks along a 230-foot tall building to store and generate renewable energy. One Danish battery start-up, which stores energy from molten salt, is sketching out plans to deploy power plants in decommissioned coal mines across three continents.

“In some ways, these are some of the oldest technologies we have,” said Kurt Engelbrecht, an associate professor who specializes in energy storage at the Danish Tech University.

He and his colleagues have long been advocating for national decarbonization programs to integrate simple, natural based storage solutions,he said, but clean batteries only began receiving real market attention as a result of energy crises of recent years.

The war in Ukraine and the subsequent political crisis over Russian oil and gas exports, was the final “tipping point,” Engelbrecht said.

The geopolitical benefits of natural batteries

Natural batteries will help renewables eclipse fossil fuels and free countries from geopolitical challenges, such as Russia’s Ukraine invasion, said Claudio Spadacini, founder of Italian company Energy Dome. The company has been considering selling a version of its CO2-based battery to clients in the United States.

“Renewables are democratic,” he said. “The sun shines everywhere and the wind blows everywhere, and if we can exploit those sources locally, using components that already exist, that will be the missing piece of the puzzle.”

But in order to succeed, natural batteries will need to provide the same kind of steady power as fossil fuels, at scale.Whether that can be achieved remains to be seen, say energy experts.

And the industry may be subject to the same pitfalls that loom over the renewables energy sector at large: Projects will need to be constructed from scratch, and they might only be adopted in developed countries that can afford such experimentation.

Lovschall-Jensen, the CEO of a Danish molten salt-based storage start-up called Hyme, says the challenge will be maintaining the same standards to which the modern world has become accustomed: receiving power, on demand, with the flip of a switch. He believes that natural batteries, though still in their infancy, can serve that goal.

“As a society that’s going away from fossil fuels, we still need something that’s just as flexible,” he said. “There’s really no other option.”