by Paul L. Jones, CPA, LEED Green Associate

It is a great day – you have just put a property you like under contract. Now the work begins…conducting your acquisition due diligence. You know the program:

- Obtain the deliverables from the seller

- Research title for exceptions and obtain insurance binder

- Ensure compliance with building and zoning codes

- Engage the appraiser

- Hire an engineer to conduct a property condition assessment

- Hire an environmental engineer to prepare a Phase I environmental site assessment

- Abstract leases and agree to the rent roll, check expense pass-through calculations and conclude on in-place and prospective income

- Analyze the market and assess the property’s competitive profile including Green certification, utility expenses (electricity, gas, water and waste) and resiliency

- Review all existing contractual relationships and obligations, including property maintenance, service and other agreements, warranties (equipment, roof, elevator, etc.)

- Obtain property insurance quote and coverage binder

- Establish the veracity of the operating statements and establish an operating budget

- Update the cash flow forecast and yield assessment to evaluate the purchase price and desirability of the investment

What if I were to tell you that with all this work, you may not have covered all your bases. Let’s go back to the purpose of your acquisition due diligence: to ensure that you are getting what you thought you were getting and to assess, eliminate or quantify the risk and rewards in the investment.

Just like your market analysis which looks at both current conditions as well as the pipeline of future competition and the affordability of new competitive construction; In a rapidly changing environment, it is important for purchasers and investors in real estate to evaluate the property’s operating and energy efficiency, indoor environmental quality and resiliency as well as anticipate future environmental, regulatory and operating conditions.

Regardless of your personal position on climate change and sea level rise, commercial real estate is going to be affected – and because of real estate’s primary characteristic – it is immovable – the effects can be significant.

- According to the report, “Risky Business: the Economic Risks of Climate Change in the United States” which was published last summer, “If we continue on our current path, by 2050 between $66 and $106 billion worth of existing coastal property will likely be below sea level.”

- FEMA is anticipating a 45% growth in the areas susceptible to flooding due primarily from sea level rise by the end of this Century – just 85 years away.

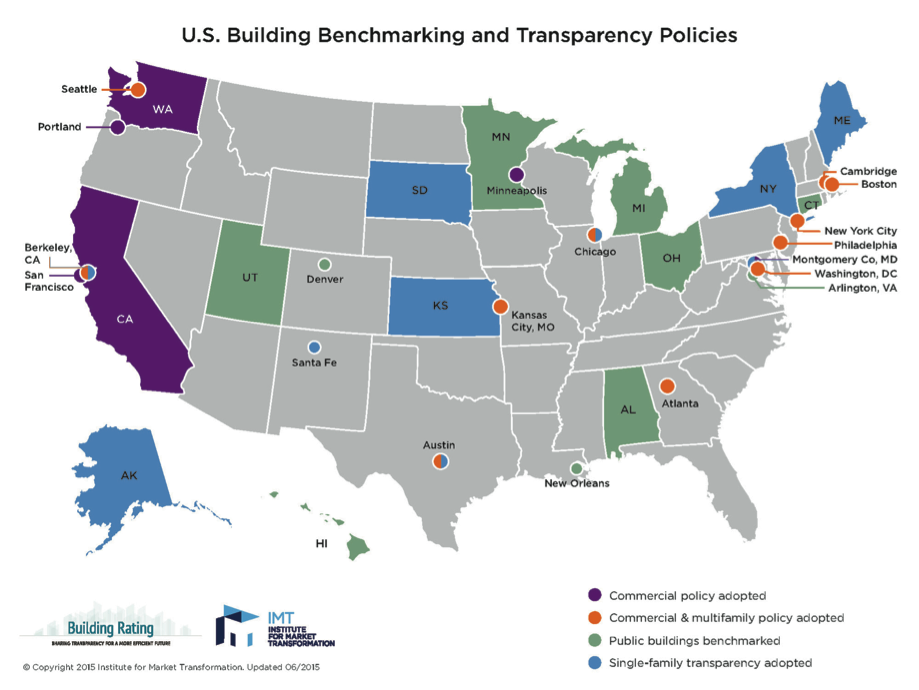

- According to the Institute for Market Transformation, “fourteen cities, two states and one county in the United States have passed laws requiring benchmarking and disclosure of energy use in buildings.” To learn more about where and under what conditions benchmarking is required, go to org. (FYI – these requirements are soon to affect over 5 billion square feet of space AND the EPA estimates that buildings that are benchmarked save an estimated 7% in energy over three years).

I live in Miami. Last week, we were in the cone of TS Erica which looked like it could grow into a hurricane. Businesses and people in South Florida began making preparations by buying staples like gas, batteries, non-perishable food supplies and reviewed their disaster plans. Thanks God the storm did not materialize and all we had was a hard rain which did cause flooding throughout our community. Climate change and sea rise are similar – you prepare for the worst and hope for the best. It does not hurt that in preparing for the worst, we actually are able to delay the time for the rise to occur (through a reduced carbon footprint). Accordingly, prudent investors are well advised to include the following additional due diligence procedures to assess the sustainability and resiliency risk inherent in the property.

- Obtain information on the risks the local community experiences due to climate change which could range from increased storm intensity and flooding due to sea level rise, wild fires and water restrictions due to drought conditions, or increased utility usage due to higher average temperatures.

- Obtain information on new or prospective municipal environmental requirements and evaluate the property leases and operations to determine the ease and cost of compliance.

- For instance, if benchmarking is going to be required, do the leases in place require the tenant to share utility usage information (if, as is the case with many properties, the tenant pays utilities directly).

- In an era of increasing utility costs and more efficient lighting, HVAC and other systems, do the leases provide for a proper sharing of the cost of replacing the equipment if it results in a reduction in utility usage? See my article on Green Leases in the Sustainable Benefits archives.

- Obtain current and prospective FEMA flood maps to ascertain the risk and timeline the property will be in a flood zone in the future.

- If the property is not a Green-rated building (LEED, EnergyStar, etc.), have the engineer assess the age and efficiency of the building systems.

- From your insurance agent, obtain information regarding anticipated future availability and rate increases.

- In evaluating the competitive leasing market, evaluate the relative absorption, rents, occupancies and tenant quality of Green buildings vs. traditional buildings to determine the market demand for sustainable buildings.

- Evaluate the building’s ability to absorb and recover from to actual or potential adverse effects of stronger storms (wind and rain), higher storm surge and more frequent flooding in coastal areas or tornados, wildfires and dust storms in other areas. Each location has its own set of risks. Some resiliency due diligence questions to ask are:

- Is the building site and entrance flood-proof?

- Is the landscape design hazard-resistant?

- Does the building have back-up power systems including HVAC and water)?

- How secure is the interior environment from damage due to higher storm intensity?

The checklist of due diligence items and questions to be answered with regard to a property’s sustainability, resiliency and ability to comply with ever evolving government, insurance company and tenant requirements needs to be customized based on the location of the property as well as its class and quality.

In a November 2014 article, “Do-or-Die Due Diligence, Auction.com Vice President Andre Cuadrado warns “The due diligence process is one of the most important, yet challenging aspects of investing in real estate. If it’s not conducted thoroughly with a keen eye, an investor could end up with bad deals and lose millions of dollars.”

Cuadrado advises investors to spend the time and resources necessary to conduct due diligence thoroughly. “Some people try to save money on the process,” he notes, “but it’s expensive to be cheap when conducting due diligence, as your investment may end up not being what you thought it was.”

Remember, as Sun Tzu is quoted from The Art of War: “Every battle is won before it is even fought.” This is true for real estate investing as well – complete and thorough due diligence is the key to risk reduction and profit enhancement.

The breadth and depth of our experience and understanding of commercial real estate due diligence, sustainability and resiliency, Emerald Skyline Corporation is uniquely qualified to be your advocate in planning and executing your due diligence needs.