Regulators and policymakers must resist the temptation to overcommit to hydrogen for end uses where electrification will ultimately win out.

By: Dan Esposito and Hadley Tallackson

View the original article here

This opinion piece is part of a series from Energy Innovation’s policy experts on advancing an affordable, resilient and clean energy system. It was written by Dan Esposito, senior policy analyst in Energy Innovation’s Electricity Program, and Hadley Tallackson, a policy analyst in the Electrification Program at Energy Innovation.

The Inflation Reduction Act has upended hydrogen economics, making “green” hydrogen — electrolyzed from renewable electricity and water — suddenly cost-competitive with its natural gas-derived counterpart.

On the supply side, electrolyzers can help utilities integrate renewables into the grid, speeding the clean electricity transition. On the demand side, electrolysis can cost-effectively decarbonize hydrogen production.

But the new hydrogen economics mean regulators and policymakers must be even more careful to avoid directing the fuel to counterproductive applications like heating buildings.

“Gray” hydrogen, which uses the highly-polluting steam methane reformation, or SMR, process, has long been the cheapest production method, trading around $1.50-2.00 per kilogram in the United States. In comparison, electrolyzed hydrogen costs about $4-8/kg without subsidies. The Inflation Reduction Act’s $3/kg incentive for zero-carbon hydrogen makes green hydrogen cheaper than gray, potentially spurring an electrolyzer boom.

To facilitate utilities connecting newly-cheap electrolyzers to the grid, regulators should set tariffs reflecting their flexibility value, empowering more bullish utility wind and solar resource procurement.

However, cheap hydrogen should not encourage its use in applications better served by direct electrification like buildings or transportation. Regulators should remain wary of gas utility proposals to blend hydrogen into pipelines, as they would achieve few emissions reductions before facing costly dead-ends while increasing threats to public safety. State policymakers should also use caution before directing public funds toward hydrogen light-duty refueling stations, as electric vehicles have substantial cost and performance advantages that risk stranding hydrogen vehicle infrastructure.

Instead, industrial consumers should use green hydrogen to decarbonize their gray hydrogen consumption for a cheaper, cleaner product.

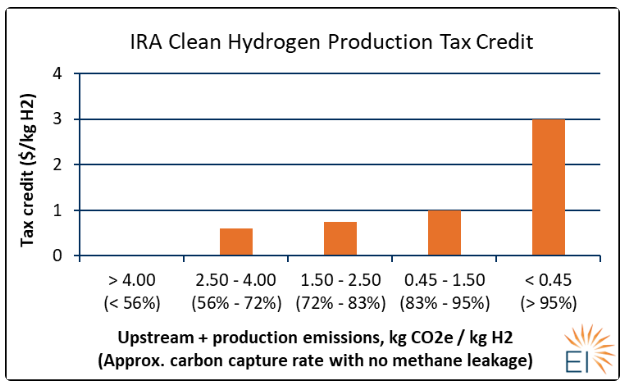

The IRA’s clean hydrogen production tax credits

The Inflation Reduction Act offers a 10-year production tax credit for “clean hydrogen” production facilities. Incentives begin at $0.60/kg for hydrogen produced in a manner that captures slightly more than half of SMR process carbon emissions, assuming workforce development and wage requirements are met. The PTC’s value rises to $1.00/kg with higher carbon capture rates before jumping to $3.00/kg for hydrogen produced with nearly no emissions.

Permission granted by Energy Innovation Policy and Technology.

However, the IRA’s “clean hydrogen” definition includes upstream emissions, including methane leakage from natural gas pipelines. Since methane is a much more potent greenhouse gas than carbon dioxide, even small leaks significantly increase the carbon capture rate needed to qualify for different PTC tiers.

This suggests “blue” hydrogen produced from pairing SMR and carbon capture and sequestration technology won’t qualify for the highest PTC value. Even hydrogen produced via pyrolysis — which uses natural gas but has no process emissions — may be knocked into lower tiers with enough methane leakage.

Green hydrogen therefore has a $3/kg subsidy advantage over gray and at least a $2/kg advantage over blue. These subsidies will be lower in practice, as the 10-year PTC will be spread over the facilities’ 15-or-more year lifetimes, but they still shift the hydrogen economics paradigm.

The opportunity: Cleaning today’s gray hydrogen while boosting renewable integration

The Inflation Reduction Act makes clean hydrogen production very cheap, but hydrogen faces costs for transportation, storage and conversion to other compounds. The U.S. also lacks hydrogen-compatible pipelines, storage caverns, refueling stations, and equipment like consumer appliances.

The first best use for clean hydrogen is circumventing these mid- and downstream cost and infrastructure challenges. Namely, clean hydrogen can plug-and-play to replace today’s gray hydrogen production.

For example, ammonia facilities and oil refineries use 90% of U.S. annual hydrogen production. Electrolyzers sited nearby can opportunistically produce clean hydrogen to reduce facilities’ fuel costs and emissions.

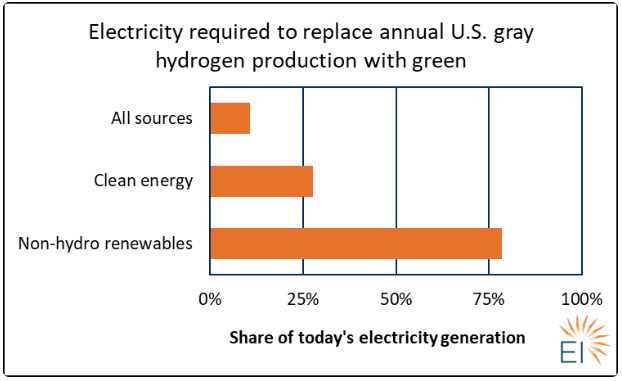

The gray hydrogen replacement market is huge — 90% of 2021 U.S. utility-scale wind and solar electricity would be required to produce it all via electrolysis. Green hydrogen also has a 25% to 50% greater GHG emissions reduction impact when replacing gray hydrogen than natural gas.

Permission granted by Energy Innovation Policy and Technology.

This process can speed renewable energy deployment. Grid-connected electrolyzers can draw from renewables when electricity is cheap, helping finance them for power that would otherwise fetch low prices or be curtailed. When electricity prices rise, electrolyzers can ramp down, allowing the renewables to meet demand and keeping hydrogen production cheap.

The combination is a win-win: grid-connected, price-responsive electrolyzers help clean the industrial sector and power grid without committing to extensive new hydrogen-ready infrastructure and appliances. As U.S. renewables deployment accelerates, the demand for complementary green hydrogen may grow apace, including feeding an enormous clean ammonia export market.

The risk: Misallocating public funds for myopic projects

The Inflation Reduction Act’s clean hydrogen PTC is a massive incentive and can make many potential hydrogen end-uses look attractive. However, these propositions are often a mirage.

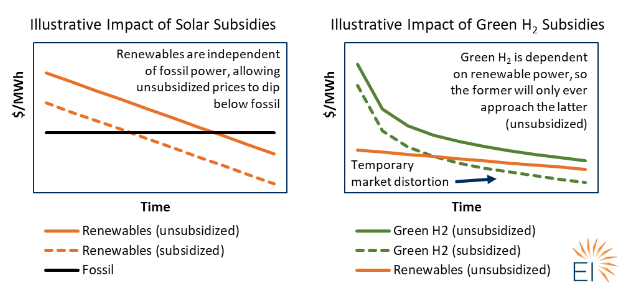

Clean hydrogen tax credits will reduce electrolyzer capital costs, helping unsubsidized green hydrogen production costs converge toward the cost of renewable electricity. However, since renewable electricity will always be an input to electrolysis, unsubsidized green hydrogen will never be cheaper than direct use of renewable electricity, even though the $3/kg credit is large enough to temporarily distort the market in hydrogen’s favor. By contrast, renewable energy subsidies are helping unsubsidized wind and solar become cheaper than fossil fuel power plants, as these resources’ costs are independent of each other.

Permission granted by Energy Innovation Policy and Technology.

Despite these dynamics, suddenly cheap hydrogen will amplify the fuel’s hype, inviting proposals for investing in hydrogen infrastructure and compatible end-use equipment. Such actions risk wasting time and money on research or infrastructure that will be underutilized or stranded once Inflation Reduction Act subsidies expire.

For example, gas utility plans to blend hydrogen with natural gas may be cost-effective with the subsidies, but they heighten safety and public health risks and aren’t long-term decarbonization strategies. By comparison, electric appliances like heat pumps and induction stoves use clean electricity approximately four times more efficiently than green hydrogen equivalents.

Other proposals may entail committing public funds to sprawling new infrastructure networks including pipelines and refueling stations to support hydrogen-powered fuel cell vehicles. Yet electric light-duty vehicles hold clear, insurmountable advantages that may be veiled by heavily subsidized hydrogen.

Hydrogen infrastructure proposals will sometimes be worthwhile. For example, geologic caverns for seasonal electricity storage can help clean the last 10% to 20% of the power grid, using green hydrogen to generate electricity when renewables and batteries are unavailable. Hydrogen can also be used as a feedstock or fuel for high-heat industrial processes. But in these cases, hydrogen’s advantage comes from filling a niche that direct electrification cannot, making its inefficiencies irrelevant.

Setting up for success

The IRA’s clean hydrogen tax credits can accelerate a reliable clean electricity transition while beginning to decarbonize industry — if applied judiciously.

Supporting a clean power grid will require incentivizing developers to connect electrolyzers to the grid rather than build standalone projects with co-located renewables, as only the former will allow utilities to benefit from electrolyzers’ flexible demand.

The U.S. Treasury should issue guidance clarifying how electrolytic hydrogen’s carbon intensity will be measured. Its framework should explicitly permit electrolyzers to connect to the grid, using collocated renewables, power purchase agreements, or potentially renewable energy credits to confirm they’re powered by renewables.

Regulators should direct electric utilities to set electrolyzer-specific tariffs, as current industrial tariffs may be mismatched with the flexibility value electrolyzers provide. They should also ease interconnection constraints and build more transmission, both of which can connect co-located renewables and electrolyzer projects to the grid. More grid-connected electrolyzers should then give regulators greater confidence to fast-track utilities’ renewable deployment schedules.

Industry consumers should explore contracts that allow clean hydrogen to replace some or all of their gray hydrogen, reducing costs and providing a cleaner product that may fetch higher prices from climate-conscious purchasers.

However, regulators and policymakers should steel their resolve against temptations to overcommit to hydrogen for end-uses where electrification will ultimately win out.

Research and development should focus on ways clean hydrogen can decarbonize hard-to-electrify sectors like aviation and shipping and boost long-duration electricity storage, rather than focusing on blending hydrogen into natural gas pipelines, using hydrogen for low-heat industrial processes, or designing hydrogen-capable consumer appliances. Limited state funds for commercialization should support electric infrastructure like electric vehicle charging stations and heat pumps, letting private companies take the risk for ventures like hydrogen refueling stations.

Together, these strategies can ensure the Inflation Reduction Act clean hydrogen tax credits maximize their value in reducing GHG emissions without inadvertently leading states and utilities down futile paths.