New law supports more predictable and consistent policies for solar, wind and other renewable energy and storage developers.

View the original article here

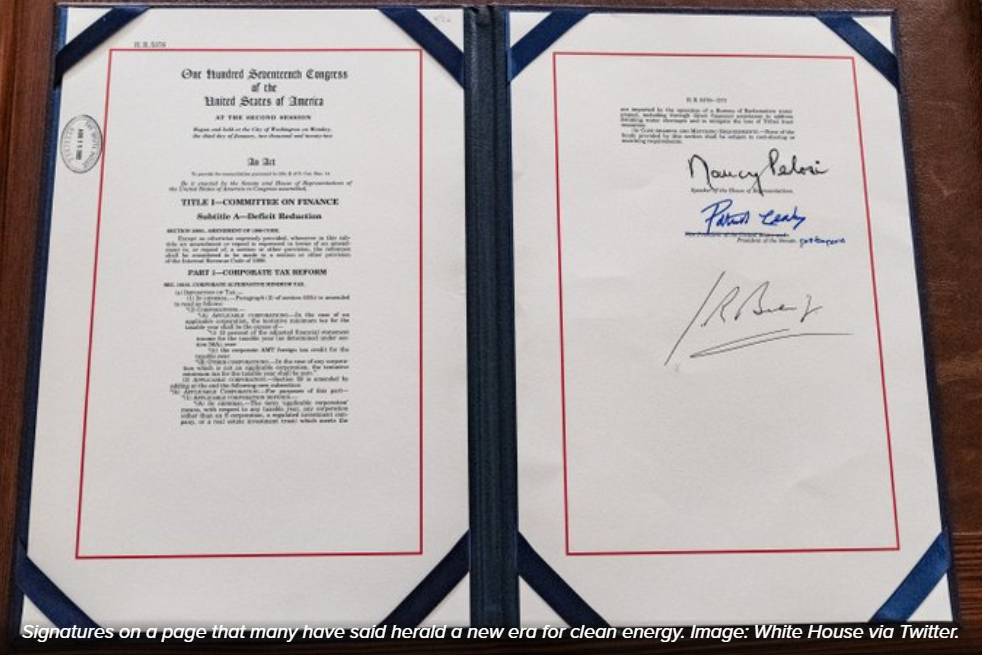

The signing of the U.S. Inflation Reduction Act (IRA) — enacted into law on Aug. 16, 2022 — heralds significant and long-term changes for renewable energy development and energy storage installations. The new law represents the single largest climate-related investment by the U.S. government to date, allocating $369 billion (USD) for energy and climate initiatives to help transition the U.S. economy toward more sustainable energy resources.

According to industry estimates, the IRA stands to more than triple U.S. clean energy production, which would result in about 40% of the country’s energy coming from renewable sources such as wind, solar and energy storage by 2030. This would mean an additional 550 gigawatts of electricity generated via renewable sources in less than 10 years.

The IRA’s expected impacts present significant opportunities for renewable energy developers and energy storage companies. Below, we discuss the law’s key effects on the renewable and storage industries, with a special focus on critical technology, software and advisory support for companies launching or expanding their renewable energy projects as the new law takes effect.

More reliable tax credit structures likely to transform renewable energy development

Crucially, the IRA establishes long-term energy tax credit structures to support renewable energy development, giving companies a more stable 10-year window for such incentives versus the previous on-again, off-again incentives that drove “boom and bust” cycles of renewables projects.

Renewables industry trade group American Clean Power reports that for the second quarter of 2022, more than 32 gigawatts of renewable energy projects were delayed, and new project development and installations also fell to their lowest levels since 2019. The group attributes these slumping performance statistics to uncertainty in tax and incentive policies along with transmission challenges and trade restrictions; provisions of the IRA may help reverse this performance trajectory.

“Historically, the U.S. renewables industry has relied on tax credits that required reauthorization from Congress every few years, which created boom-bust cycles and significant challenges in terms of planning for long-term growth,” explained Gillian Howard, global director of sustainable energy and infrastructure at UL Solutions. She added that the IRA establishes a 10-year policy in terms of tax credits for wind, solar and energy storage projects. The new law also provides incentives for green hydrogen, carbon capture, U.S. domestic energy manufacturing and transmission, Howard noted.

“We expect the IRA to both significantly accelerate and increase the deployment of new renewable energy projects in the U.S. over the next decade,” Howard says. “This will be transformational.”

Standalone storage now eligible for tax credits: a long-awaited change and major IRA impact

The use of energy storage has taken on added urgency in recent years as extreme weather and geopolitical issues increasingly challenge energy access and reliability. Projects for energy storage, including batteries and thermal and mechanical storage, have previously been included in investment tax credit programs. Now the IRA extends tax credits for energy storage through 2032. The new law also opens tax credit eligibility to standalone energy storage, which entails storage units constructed and operated independently of larger energy grids.

“Providing an investment tax credit for standalone storage is the single-most important policy change in the IRA — period,” said David Mintzer, energy storage director at UL Solutions. “This one change sets up all of the other energy storage advantages gained from the new law. Those of us in the BESS industry have been waiting for this to happen for more than 10 years, and this is the most significant legislation to accelerate the transition to clean energy and smart grids.”

Mintzer noted that the IRA allows placement of battery energy storage systems (BESSs) where energy demand is highest and removes longstanding requirements that storage systems must be paired to solar sources. Accordingly, key impacts of the new law on energy storage projects in the U.S. will likely include the following near-term impacts:

- Standalone utilities – The IRA provides more substantial economic incentives for more sites (nodes) that connect to grid networks in support of wholesale energy and additional dispatch services.

- Standalone distributed generation – More flexible placement of standalone BESSs can support economic arguments for commercial development at sites with inadequate access to larger energy grids.

- Storage technologies – The IRA’s tax credit provisions for standalone energy storage will prompt research and development and, ultimately, the execution of more and different types of batteries.

- Banking – Smaller banks and lending organizations may be more likely to finance the construction and development of smaller energy storage systems versus larger and costlier main-grid projects.

“This decoupling of the storage-solar rules will enable BESS sites to be placed where they can provide the best economic returns,” Mintzer explained, adding that battery use will also become more flexible to better support energy grids. Ultimately, Mintzer said, developing and deploying more storage systems will help the U.S. achieve its clean energy goals.

Solar provisions: PTC versus ITC

The IRA includes provisions for 100% production tax credits (PTC) for solar, which transitions to a technology-neutral PTC in 2025. Until the passage of the IRA, solar developers could use the investment tax credit (ITC), which was originally set at 30% of eligible project costs, stepping down over the last few years to 26%, 22% and 0%. The IRA reset the ITC to 30% and provides an option for developers to opt for the PTC instead of the ITC. Rubin Sidhu, director of solar advisory services at UL Solutions, said, “Preliminary analysis shows that for projects with a high net capacity factor (NCF), PTC may be a more favorable option. Further, as solar equipment costs continue to decrease and NCFs continue to go up with better technology, PTC will be more favorable compared to ITC for more and more projects.”

Since the PTC is tied to actual energy generation by a project over 10 years, we expect the investors will be more sensitive to the accuracy of pre-construction solar resource and energy estimates, as well as the ongoing performance of projects.

Tools to support renewable energy development and storage in the IRA era

Launching renewable energy development and storage projects under the auspices of the IRA will require robust tools and technologies in order to manage these projects’ technical, operational and financial components in what may well become a more highly competitive and crowded field.

The degree to which a renewable energy developer will require third-party technologies and advisory partnerships will depend on the firm’s internal resources and commercial goals. Our experience at UL Solutions assessing more than 300 gigawatts worth of renewable energy projects has been that some firms require tools to evaluate and design projects themselves, while other companies seek full-project advisory support. To accommodate a diverse array of technology and advisory needs across the industry, UL Solutions has developed products and services, including:

- Full energy and asset advisory services.

- Due diligence support.

- Testing and certification.

- Software applications for solar, wind, offshore wind and energy storage projects.

Effective tools for early-stage feasibility and pre-construction assessments are crucial for the long-term viability of renewable energy development projects. UL Solutions provides modeling and optimizing tools for hybrid power projects via our Hybrid Optimization Model for Multiple Energy Resources (HOMER®) line of software, including HOMER Front for technical and economic analysis of utility-scale standalone and hybrid energy systems, HOMER Grid for cost reduction and risk management for grid-connected energy systems, and HOMER Pro for optimizing microgrid design in remote, standalone applications. UL Solutions also supports wind energy assessment projects with our Windnavigator platform for site prospecting and feasibility assessments, Windographer software for wind data analytics and visualization support, and Openwind wind farm modeling and layout design software.

For energy storage system developers, HOMER Front also features tools to design and evaluate battery augmentation plans as well as dispatch strategies, applicable when participating in merchant energy markets or contracting with power purchase agreements.

Conclusion: Reliable tools for a new frontier

Given the magnitude and scope of the IRA, it will take some time for regulatory implementation to play out. Effects of the new law will not be immediate. Over time, the IRA will provide more predictability and certainty in terms of tax credits and related incentives for renewable energy development and lays the groundwork for innovation and expansion of energy storage systems and technologies. Gaining a competitive advantage in this new era for renewables, nonetheless, will require the right software capabilities, third-party advisory support or both, depending on companies’ resources and commercial objectives.