Written By: Bernard Marr

View the original article here

Adobe Stock

From cooking food to heating and lighting our homes and powering industry, energy is central to life on Earth and the advancement of human society. But the way we access, store and use energy is evolving rapidly, driven by environmental concerns, new technological developments and geopolitical challenges.

The impact of this change is likely to become more dramatic as we head into 2025. As the world faces new climate and energy security challenges, innovation and changes in human behavior will both be vital to finding solutions. So, here’s my roundup of what I believe will be the most important trends around new energy sources and energy transformation in 2025.

AI In Energy Infrastructure And Management

Predictive analytics and smart energy optimization solutions, all made possible thanks to the ongoing AI revolution, will continue to enable more precise forecasting of energy demands and real-time optimization of energy generation, storage and distribution. It will also play a role in green energy exploration. Companies like Shell are already leveraging AI to help identify deposits of biofuel, as well as optimize the placement of EV charging stations, and accelerate their research into clean energy solutions.

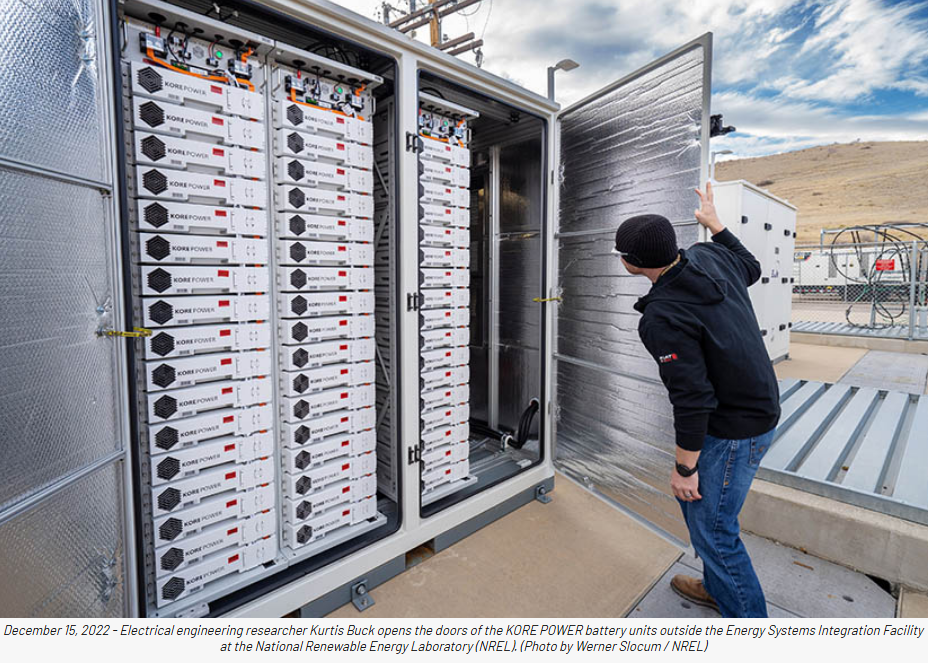

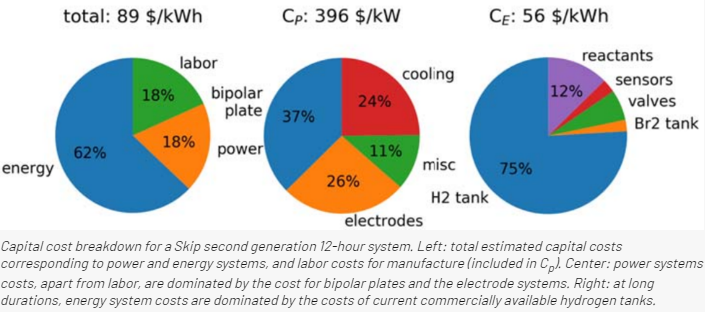

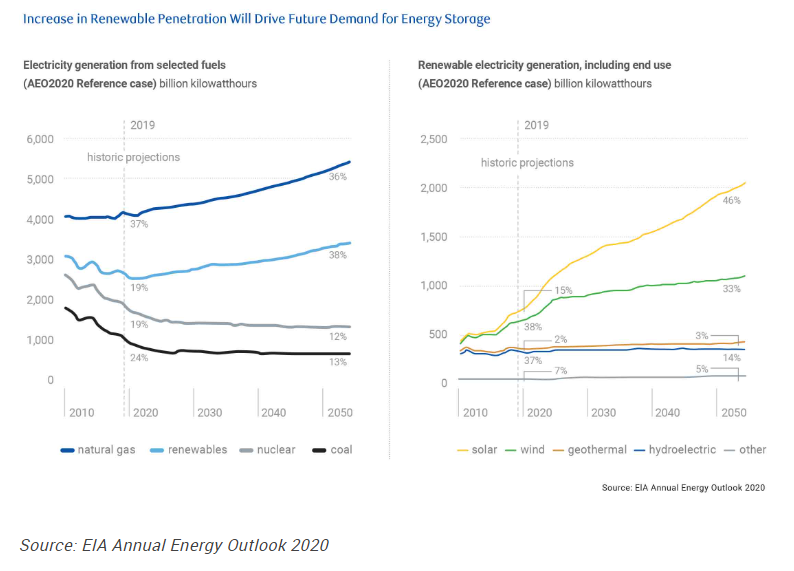

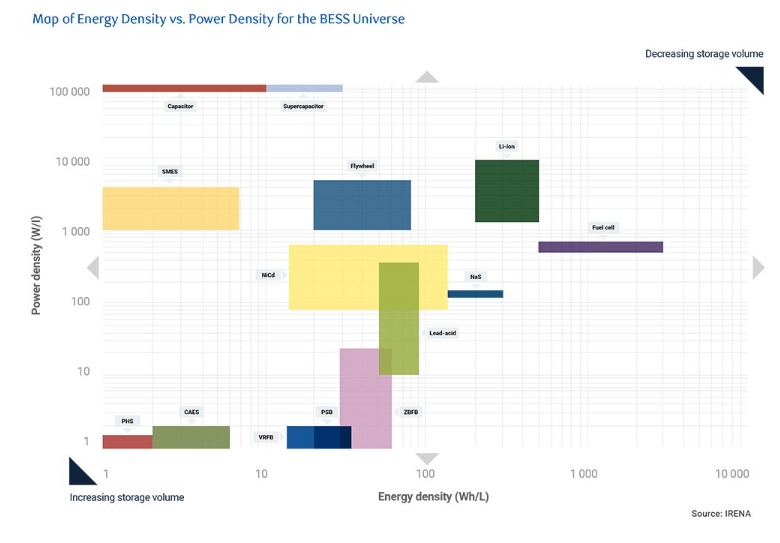

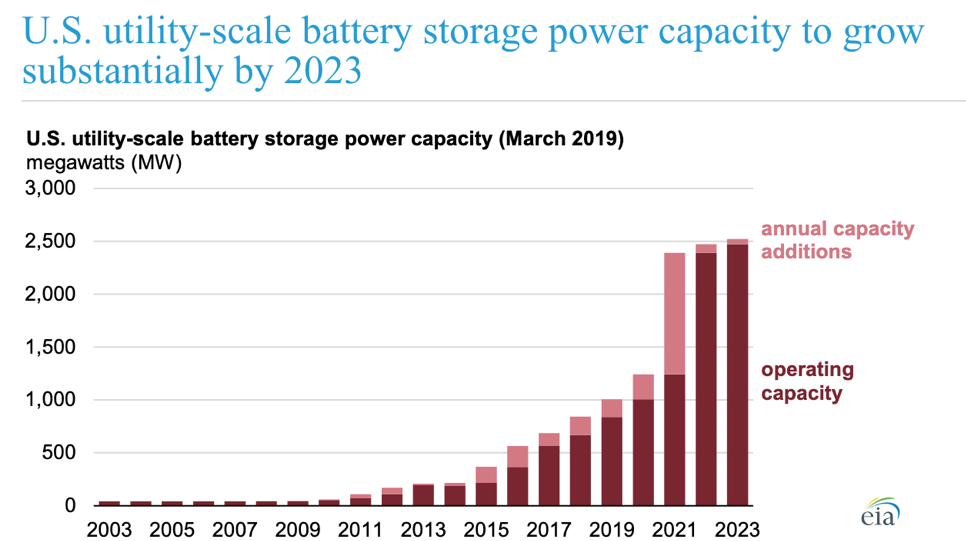

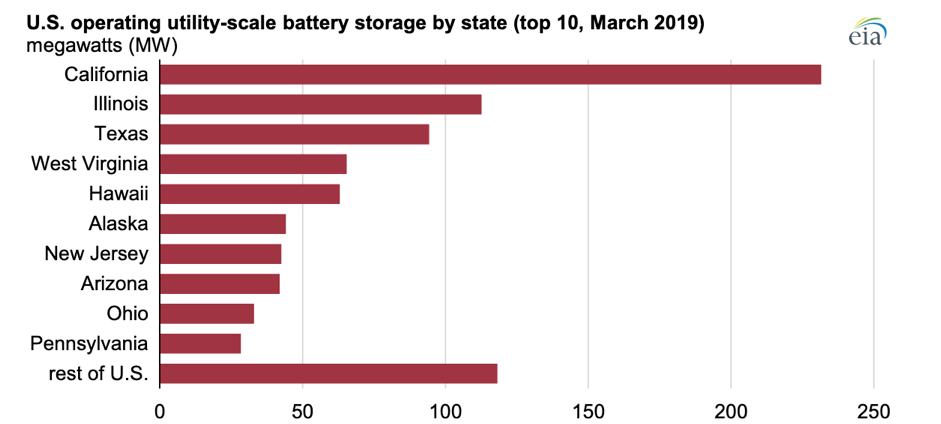

Innovation In Energy Storage And Battery Technology

New types of battery storage, such as solid-state and flow batteries, will continue to make renewable energy storage a more viable solution in 2025. This will enable more reliable integration of solar, tidal and wind energy sources into energy grids, with scalable solutions that address the problems of intermittency that traditionally come with these methods of generating power. Other potential solutions will come in the form of thermal energy and compressed air storage, creating further possibilities for easing the energy crisis.

Decentralized Energy Production

Rather than centralized energy production carried out at large facilities, the principle of decentralized energy involves millions of smaller-scale microgrids and energy-sharing systems, combining renewable and clean energy generators with AI-powered management systems. These could be owned and operated by community groups or neighborhoods, creating local energy ecosystems that will increase energy resilience and reduce reliance on central providers. In 2025, we will see this trend helping to support the transition to greener energy use, particularly in rural and remote areas.

Geopolitics Drives Energy Security Challenges

Turbulent political tensions are forcing nations to prioritize energy security, diversify their supply of energy, and develop new supply routes. In 2025, many companies – particularly those that are reliant on energy supplied by countries involved in war or political trouble – will focus on reducing dependency on imports and increasing domestic energy production. This will involve challenges that may be dependent on the will of politicians or the voting public, such as making choices between further exploiting natural resources and investing in green energy solutions.

The Nuclear Options

The development of small modular reactors, as well as potential breakthroughs in the quest for fusion, promise safer and more easily affordable nuclear power. This could create new opportunities for reliable, low-carbon power generation that will increasingly be used alongside renewable energy in the pursuit of clean energy goals. SMRs are smaller, safer and cheaper than conventional nuclear power plants, meaning they are increasingly being seen as an attractive option for replacing aging fossil fuel plants in 2025. Some, however, remain concerned that not all concerns around nuclear power will be alleviated.

Addressing Energy Inequality

The need to address energy poverty and inequality is increasingly becoming a global priority. Across the world, billions of people still have limited or no access to reliable electricity supplies, severely endangering their health and limiting the possibility of economic development. In 2025, developing new methods of supplying affordable and clean energy to some of the most underserved regions will be an increasingly urgent priority.

New Developments In Renewable And Green Energy Sources

Worldwide, there is still a tremendous appetite for replacing fossil fuels and polluting energy supplies with clean, green alternatives. As well as new developments in renewable generation such as more efficient, integrated solar panels (photovoltaics) and floating wind farms (floatovoltaics), green hydrogen is emerging as a viable solution for reducing carbonization of industries such as steel and chemical production, as well as transport.

The Human Factor

The most critical element in energy transformation could be the role played by human behavior. From the appetite for transitioning away from fossil fuels to participation in community energy programs, the question of whether individuals will be willing to make changes to their habits will be a deciding factor. Legislation will play its part but may provoke kickback if handled too heavily, as seen by the reaction of some to measures such as EV mandates. Education will be even more vital in raising awareness of the deadly scenarios we will face in the future if we don’t effectively manage energy transitions today.