Paul L. Jones, CPA, LEED Green Associate, Principle, Emerald Skyline Corporation

Paul L. Jones, CPA, LEED Green Associate, Principle, Emerald Skyline Corporation

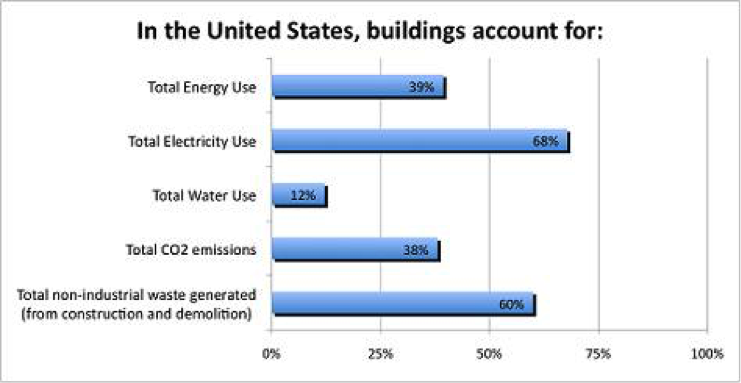

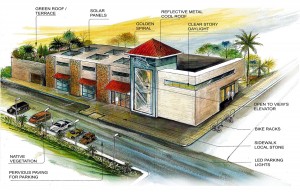

A sustainable retrofit includes replacements and upgrades that result in lower energy, operating and maintenance costs as well as improved occupant satisfaction. A sustainable facility will have a small carbon footprint, limited environmental impact and conserves natural resources. They can range from replacing conventional lights to LED bulbs, adding motion-control switches and installing low-flow water fixtures to installing a green roof, replacing the building skin and adding solar panels to all of the above.

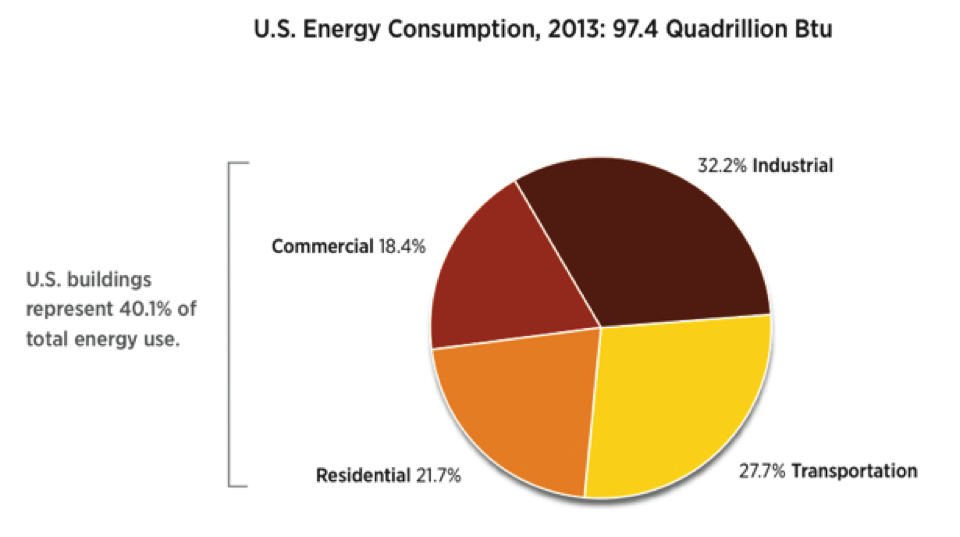

When you fully understand the economic benefits of doing a sustainable retrofit which include lower expenses and rent and occupancy premiums resulting in higher NOI as well as reduced cap rates resulting in higher long-term values, you realize how few property owners, managers and tenants have actually made the decision to pursue an upgrade of their building(s), it initially does not compute a United Nations Environmental Program Finance Initiative Investor Briefing entitled “Unlocking the energy efficiency retrofit investment opportunity” reports:

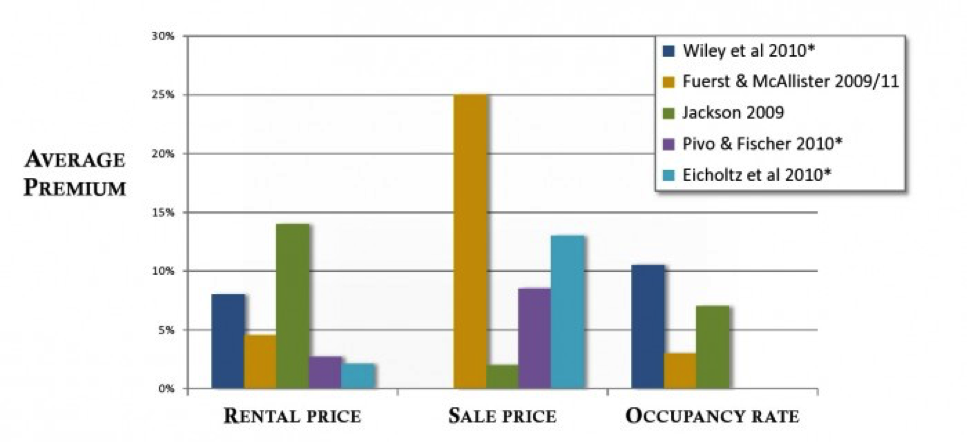

- Buildings with the Energy Star label had significantly stronger performance than similar unlabeled buildings: 13.5% higher market values, 10% lower utility costs, 5.9% higher Net Operating Income (NOI) per square foot, 4.8% higher rents and 1% higher occupancy rates.

- A study using Co-star data concluded that LEED-certified buildings and Energy Star rated buildings versus non-rated buildings had 8% higher effective rents (a function of both the rental amount and the occupancy rate) and a 13% sales price premium.

See also my article, “Welcome to Sustainable Benefits – Let’s begin with the benefits of doing a commercial building sustainable retrofit” for additional survey results and case studies that demonstrate the results building owners and managers have realized.

In a 2012 study by The Rockefeller Group and Deutsche Bank Climate Change Advisors, however, reported that approximately $72 billion in capital is needed to be invested in sustainable retrofits to effect profitable energy efficiency in the existing building stock. However, the total spent in 2012 was just $1.5 billion.

Once you understand the relative perspective of the stakeholders in both the investment and the benefits, the resistance to effecting a sustainable retrofit can be understood. Let’s dissect the framework in which the decision to make sustainable improvements are made and the issues and motivations that cause a property owner not to update and improve their property which are:

- Short-term investment horizon

- Incongruous lease structure

- Capital and operating budget limitations

- Financing availability, complexity and/or cost

- Limited knowledge, time and/or motivation to effect energy upgrades

Understanding these investment, operational and financial constraints is the first step in developing solutions that will result in making the sustainability and resiliency of the existing stock of commercial buildings feasible and practical.

Short term investment horizon:

In the era of REITs, CMBS, hedge funds, crowdfunding and private equity, investment hold periods are frequently in the 3 – 7 year range when investors can typically optimize the IRR and other profitability measures or bail on a bad investment and reallocate their capital. As a result, many investors will only consider sustainability measures that have a two-to-three year payback period. Deep energy retrofits with savings of 30% to 50% that result from retrofitting multiple building systems requiring more time and capital to effect are tabled and not done.

Solution: The current and prospective investment environment will continue to reflect hold periods that are relatively short; however, the solution is for investors, owners and managers to realize that a sustainable retrofit enhances the long-term value of the property and will cause investment returns to increase. Including the costs and benefits of upgrading a building is a common way for sponsors to demonstrate the inherent value of a property – especially one that is not fully leased or suffers from functional obsolescence or poor aesthetics and other physical limitations on its marketability to prospective tenants. Many business plans include upgrading a building from one class to a higher class which results in increased rents and lower cap rates. As evidenced by many studies, including sustainability and resilience in the business plan is an increasingly important component in any market-oriented building upgrade. The solution is for sponsors, investors and owners to realize this and to put it into practice.

Future articles will present sustainable ideas many of which can be implemented with no capital investment required.

Incongruous Lease structure

Commercial buildings, a/k/a income properties, are leased to tenants pursuant to a variety of lease structures with the four most common being as follows:

- Gross Lease, or full service gross, is a lease where the landlord/owner collects a stipulated rent amount and is pays all expenses including real estate taxes, insurance and operating expenses that are comprised of utilities, repairs and maintenance and management. The room rate paid for a night in a hotel and a lease for a self-storage unit are examples of gross leases.

- Apartment leases are typically considered to be a gross lease as the landlord is usually responsible for all operating expenses including real estate taxes, building insurance, common area maintenance and utilities, and property management while the tenant is responsible for the unit’s electricity (and sometimes water) and interior maintenance.

- Modified Gross Lease is a gross lease where the landlord/owner collects a stipulated rent amount plus a reimbursement of real estate taxes, insurance and operating expenses which exceed an agreed upon amount which is typically an estimate of the building expenses for the initial lease or calendar year. Typically, at the end of the year, the actual expenses are reconciled to the estimate and any increase is passed to the tenant based on its pro-rata share. Most multi-tenanted office buildings are leased pursuant to modified gross leases.

- Net Lease is a lease where the landlord/owner collects a stipulated rent amount plus building expenses which include real estate taxes (net), taxes and insurance (double net); or taxes, insurance and operating expense (triple net) depending on the terms of the lease. If the building is multi-tenanted, the tenant pays its pro rata share. Most net leases are currently triple net. Retail properties are typically leased using a triple net lease.

In a standard Full Service lease, there is no split incentive in the lease structure as any and all savings realized from a sustainable retrofit inure to the benefit of the owner; however, the property manager may not be incentivized to promote a retrofit as it would be responsible for supervising and effecting the improvements without any additional management fees. With regard to an apartment complex, the landlord’s incentive to invest in energy efficiency measures is limited to the common areas – or to improve the competitive position and marketability of the units to prospective tenants.

In a standard Modified Gross lease as well as a Net lease, the landlord/building owner is not incentivized to invest the time, money and personnel resources to effect a sustainable retrofit as the landlord receives no direct financial benefit as the tenant pays the operating expenses and receives all of the benefit of lower operating costs.

Solution: Creating a lease structure that equitably aligns the costs and benefits of efficiency, sustainability and/or resiliency between building owners and managers, known as a green lease, aligned lease, high performance lease or energy efficient lease, will create sustainable and substantial benefits, both quantitative and qualitative, for both tenants and owners/landlords.

- According to Jones Lang LaSalle, “A green lease need not be complicated. Often it merely requires structuring terms and agreements already in place, such as temperature settings and building operating hours, in a fashion that provides sustainable cost savings with negatively impacting building performance.”

To effect a green leasing program that includes both current and prospective tenants, engaging a consultant that understands both commercial lease structures and efficiency and sustainability retrofits to maximize the sustainable benefits to be derived therefrom.

Green leases will be addressed in detail in a future article.

Capital and operating budget limitations

Many properties suffer from a breakdown in communication and financial planning between building managers and building owners. Building managers typically operate a facility pursuant to a one-year budget which causes them to budget and implement projects with a short term (1- 2 years) payback period. Consequently, capital improvements that have a longer payback period are not often recommended by management, or if recommended, not implemented by ownership due to a combination of knowledge, time or motivation to consider an energy upgrade or a perceived lack of available capital. This short-term horizon again limits the nature and extent of any efficiency or sustainable upgrades and prevents ownership from reaping all of the economic benefits that inure from a building retrofit.

Further, many times neither building ownership nor building management understand the nature and availability of financing options, tax credits, utility and local government rebate programs. Some of the programs, or a combination of programs, can result in building owners not having to come out of pocket to fund the improvements; however, the unique nature of them requires time which is typically focused on achieving the primary business goals of the organization.

Solution: Engage a sustainability consultant with knowledge of property operations and management as well as the nature of the available financing, credits and rebates – and how to source and evaluate alternatives in order to minimize actual investment dollars and the cost of any financing incurred. Conducting a life-cycle analysis in addition to other financial analyses will provide ownership with the information needed to make the business decision.

Future posts will present investment analysis tools and methodologies with examples of the real economics of sustainable retrofits.

Financing availability, complexity and/or cost

Contrary to popular belief, energy efficiency and sustainability retrofits benefit from a variety of financing alternatives. However, for real property professionals who work with mortgage loans, mezzanine loans, preferred equity and similar forms of financing, retrofit financing options ranging from equipment leases to ESCO (Energy Service Company) contracts and PACE (Property Assessed Clean Energy) liens is a whole new world. When you add in the variety of tax credits, utility rebates and vendor financing, the options become complex.

Further, the sources for financing a retrofit are not usually the same ones that provide mortgage financing so it is a new arena which makes accessing sources and evaluating options time consuming and prohibitive.

Solution: Engaging a professional who is familiar with the types and sources of retrofit financing as well as the typical structures and issues of which owners should be aware is the easiest and most efficient way to determine and evaluate the options based on the financial and non-financial objectives of the owner.

The various retrofit financing options, examples of tax credits and utility and municipal rebates will be described and explained in future posts.

Limited knowledge, time and/or motivation to effect energy upgrades

In today’s competitive commercial real estate environment that is still recovering from the devastatingly harsh Great Recession of 2007, keeping your focus on the primary business of keeping space leased (as hoteliers say – heads in the beds) and watching every penny to the bottom-line is the first priority of owners and managers.

Even though the results of an efficiency, sustainability and/or resiliency retrofit provide a substantial boost to the net operating income (and cash flow) of a property, it does not become a high priority item due to lack of understanding of the process, the capital, management and labor requirements, the extent of the potential disruption to operations and tenants as well as knowledge of the additional value (rent premiums, occupancy premiums, higher quality tenancy, lower cap rate, increased investment value) and business benefits (reputation, image, goodwill) to be derived therefrom.

Also, many times building management staff, who may have the understanding of the sustainability technology will not have the financial literacy to present a compelling case to ownership.

Further, many energy service providers (who are typically considered to be the expert in facilitating a retrofit) do not know or understand the financing options that are available to building owners. Accordingly, these professionals are not able to property advise an owner on energy project financing. Accordingly, many owners are not aware of, nor understand, the variety of financing mechanisms available to them.

Solution: Learn enough to realize that it is worth the time to learn about the options that are available, hire a sustainability consultant, architect or engineer to analyze the property, benchmark its energy and water usage and understand other maintenance practices, have the systems retro-commissioned to determine how well they are performing and develop an efficiency, sustainability and/or resiliency retrofit plan. Implement the plan and start realizing the benefits.

Our Sustainable Benefits blog will be your resource to learn and understand the new world we are transitioning into – one in which we leave the world better off for having lived (Emerson).

By Julie Lundin, NCIDQ, LEED AP ID+C, ASID

By Julie Lundin, NCIDQ, LEED AP ID+C, ASID

motor vehicle licenses, welcome signs and marketing campaigns. While Florida promotes itself as the Sunshine State we are not utilizing our most abundant and natural resource, solar power.

motor vehicle licenses, welcome signs and marketing campaigns. While Florida promotes itself as the Sunshine State we are not utilizing our most abundant and natural resource, solar power.

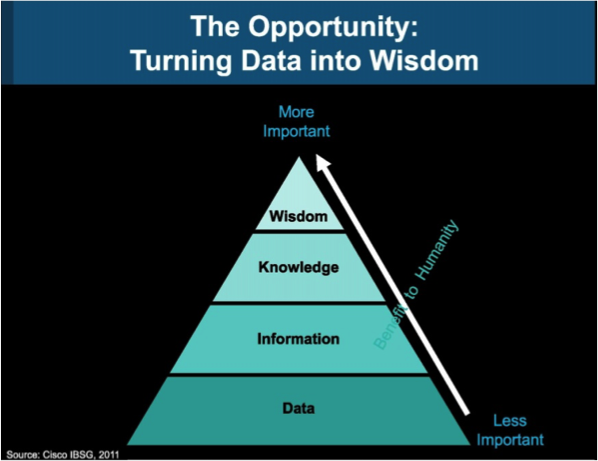

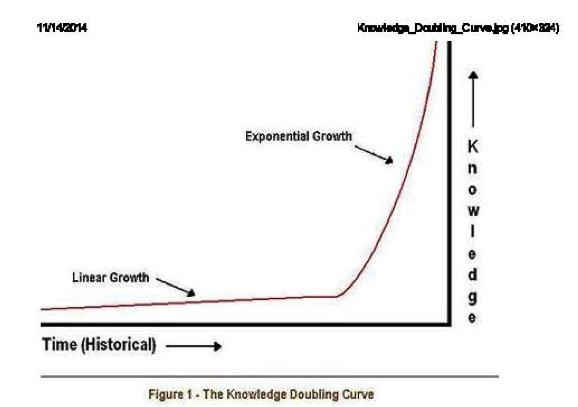

ans nearly 198,000 years to accumulate, and used that as the benchmark; the amount of human knowledge would take another 1,500 years to double. With the introduction of the printing press, the pace of growth in human knowledge started to accelerate with another doubling occurring in about 250 years. By 1900 (around 150 years), human knowledge had doubled again. By the end of World War II, knowledge was doubling every 25 years. At the time Critical Path was published, Fuller estimated that human knowledge was doubling every 18 months. Now, Human knowledge is estimated to double every 13 months. With the internet and other advances in human communication and data storage, IBM predicts that human knowledge is soon to double every 12 hours.

ans nearly 198,000 years to accumulate, and used that as the benchmark; the amount of human knowledge would take another 1,500 years to double. With the introduction of the printing press, the pace of growth in human knowledge started to accelerate with another doubling occurring in about 250 years. By 1900 (around 150 years), human knowledge had doubled again. By the end of World War II, knowledge was doubling every 25 years. At the time Critical Path was published, Fuller estimated that human knowledge was doubling every 18 months. Now, Human knowledge is estimated to double every 13 months. With the internet and other advances in human communication and data storage, IBM predicts that human knowledge is soon to double every 12 hours.